Trustee and Custodian Banks

Hatton National Bank /

Deutsche Bank AG

Licenced and Regulated by

Securities and Exchange

Commission of Sri Lanka

Associate Company of

Our Performance

Year To Date Returns as at 28th March 2025 (Non-Annualized)

Years of Experience that you can depend on.

We take pride in pioneering a USD Sovereign Bond Fund in Sri Lanka, “The Ceylon Dollar Bond Fund” with Deutsche Bank AG as the Trustee and Custodian, also managing a wide range of LKR funds to suit all your investment needs, with the Trustee and Custodian bank been Hatton National Bank.

All funds are audited by Ernst & Young Global Limited.

The company has been in existence since 1999, and has been an associate company of Sri Lanka Insurance Corporation since 2010.

Our Funds

“Ceylon Financial Sector Fund”

The Top performing STOCK MARKET fund in Sri Lanka !

102.60%

*Year To Date return (non – annualized) as at 31st July 2023.

Source : The Unit Trust Association of Sri Lanka

Past performance is not an indication of future performance

*Source Bloomberg [CEYINDF:SL]

Investors are advised to read and understand the content of the explanatory Memorandum

Fees and charges apply

Ceylon Treasury Income Fund

The Ceylon Treasury Income Fund (CTIF) Provides Investors an opportunity to invest exclusively in Government Securities. Treasury Bills and Bonds are tradable in the secondary market, customers have maximum liquidity and can exit at any given time (open-ended). The CTIF is exempted from withholding tax deduction since unit trust acts as flow through. However, individual tax brackets will apply to investors.

Ceylon Index Fund

CIF invests in the top 10 blue-chip companies and allows Investors to invest and exit at any time. They are well-positioned to take advantage of a broader stock market while it is highly diversified (minimum stock specific/ minimum sector-specific risk) and liquid given the blue-chip portfolio and strongly related to the ASPI. We are pleased to say that the CIF is the best-performing equity fund YTD (31/12/21) with a return of over 112.09%.

Ceylon Financial Sector Fund

CFSF has an exposure to top 6 banks & 4 finance companies listed in the Colombo Stock Exchange (CSE) and allows Investors to invest and exit at any time. The fund tracks over 55% of the total market capitalization of the banks & diversified finance companies in Sri Lanka. This sector is one of the most lucrative sectors in the country.

Ceylon Tourism Fund

Ceylon Tourism Fund mainly invests in listed Hotels in the Consumer Service sector in Colombo Stock Exchange. The fund covers 56.4% of the sector market capitalization. The Investment Objective the Fund seeks to provide medium to long term hotel sector returns while minimizing stock specific risk by investing / tracking the most liquid tourism sector companies (Tourism Top 10 Index).

Ceylon Income Fund

A medium-term Fixed Income Fund that invests in investment-grade (BBB- or above) rated corporate debts.

Ceylon IPO Fund

For the first time in Sri Lanka, a Unit Trust Invests exclusively on attractive IPOs on your behalf. The fund offers retail investors an opportunity to secure a larger allocation in IPOs. The fund will not invest in any other shares in the secondary market. Therefore, the fund is formulated to provide maximum returns to its investors in the short term.

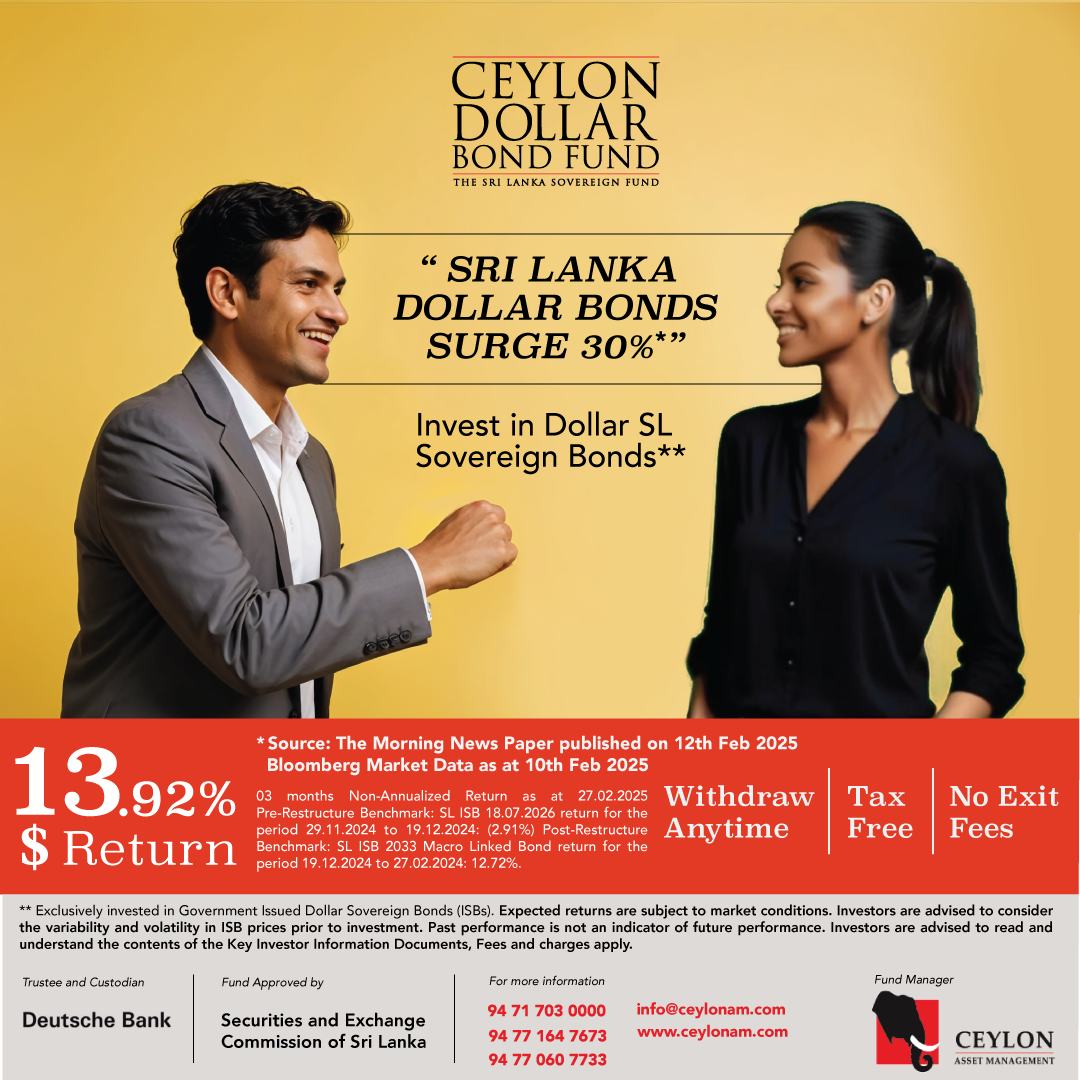

Ceylon Dollar Bond Fund

The CDBF offers a unique opportunity to invest exclusively in Sri Lanka Government Issued Sovereign Bonds that are listed on the Singapore Exchange and traded globally.

Ceylon Money Market Fund

We are pleased to inform you that our Money Market fund formally known as the Ceylon Money Market Fund, emerged as the Top-performing Money Market Fund in Sri Lanka as at 31st Dec 2021. The main objective of this fund is to preserve investor capital. It is a short-term debt fund that invests in commercial papers & fixed deposits less than a year etc. The interest is daily accrued during the period of investment. Our Money Market fund is currently offering a net return of 8.06% as at 31/12/21 (subject to market conditions). Furthermore, investors are allowed to withdraw or expand their investments at any time without penalties (minimum investment is 5,000/-).

Fund Prices

As at 28th March 2025

(Non- Annualized)

Ceylon Treasury Income Fund

Ceylon Index Fund

Ceylon Financial Sector Fund

Ceylon Tourism Fund

Ceylon Income Fund

Ceylon IPO Fund

Ceylon Dollar Bond Fund

Ceylon Money Market Fund

We are happy to answer your questions and concerns. Please fill out the form and we will get in touch as soon as possible.

Latest News & Updates